According to reports by the Nigerian bureau of statistics, the Nigerian economy is battling recession after a two time slum in its growth. A recession is defined as two consecutive quarters of negative growth. This was evidenced in 3rd quarter decline of about -0.36% compared to 2.06% in the second quarter. This figure stands against the value of 2.11% closing value for the economy in the 4th quarter of 2015 as reported by Nigerian Bureau of statistics.

The drastic drop in oil prices has seriously affected the economy as its revenue is mostly generated from the export of crude which accounts for 70% of government revenue and 95% of export income as reported by the National Bureau of statistics.

As oil prices fell from over $100 a barrel in June 2014 to under $50 today, government revenues fell drastically, leaving Nigeria with a $7 billion budget deficit.The currency move, dwindling oil prices, pipeline vandalism in the oil rich Niger Delta coupled with other global economic dynamics has led Nigeria to losing its title as Africa’s largest economy.

On the 15th of June, Nigeria’s central bank abandoned it currency peg on the naira and since then, the naira has fallen 61% against the US dollar, generating difficulties for both foreign and domestic businesses in Africa’s most populous country. This has led to Foreign-exchange trading restrictions, import curbs, shortages of goods from gasoline to milk and contributed to the contraction in factory output in the country of the past months. These measures drove airlines such as United airline, Aero contractors, Iberia, etc. to cut off routes to Nigeria. They also left domestic operators with huge fuel shortages. Businesses in other industries suffered as well; the banking sector is heavily crushed as their share prices nosedived in the stock market. In fact, the Nigerian stock market has been consistently reporting reduction in market capitalization as investors’ funds are continuously reduced to dust through decline in stock values.

Meanwhile, militants such as the Niger Delta Avengers (a new militant group in the oil rich Niger Delta) and other pipeline hunters are blowing and destroying pipeline installations in the country thereby exacerbating the country’s oil revenue shortage. This oil Sabotage has cost the country about 800,000 barrels per day as reported by Vanguardngr.com , sending the country’s output down to its lowest level in almost three decades with many oil companies abandoning the oil rich Niger delta.

Also, while the fight to suppress the Boko haram insurgence in the north east is still on, Fulani herd’s men are taking up arms against innocent civilians in some communities. This is yet another violence challenges that the country has to grapple with.

ALSO READ:BRINGBACKOURGIRLS-HOPE STILL REMAIN ALIVE

Given this backdrop, it shouldn’t be a surprise that the economy is in tatters. Growth slowed from 6.3% in 2014 to 2.8% last year, and the IMF says the economy could shrink by 1.8% by the end of 2016.

Currently, inflation rose to an 11-year high of 16.5% from 15.5% in the previous quarter, while business confidence has hit all-time lows as investors are scared of the uncertain investment climate in the country. Also, the unemployment rate has increased by 18.7% from last quarter of 2015 resulting to serious unemployment problem in the country.

The slowing economy is particularly problematic for a country that is adding 13,000 new people to its population every day. With a population growing at 2.7% per year, it is projected that by 2050, the country is expected to have roughly 400 million people in its population. Hence, the economy needs to maintain a good level of growth to improve the incomes of its citizens.

One of the strongest impediments to growth in the country has been corruption. Nigeria lies in the bottom 20% of nations on Transparency International’s Corruption Perception Index. Muhammadu Buhari, who was elected president with a mandate to help check corruption seem to be making progress. In June, the government announced it had seized over $10 billion worth of stolen wealth. But some are worried that his administration is just fighting corruption with little or no insights on how to position the economy of the country.

HOPE FOR RECOVERY!

Despite the ugly outlook of the Nigerian economy, it still holds good returns for those who are willing to take a dive. The fall in the currency could be an opportunity for entrepreneurs and exporters who can source their materials locally and sell their finished product in the international market thereby giving them favorable forex exposure.

Petroleum refining sector could be another opportunity spot. Nigeria still depends on imported refined products to power its industries. Some opportunity driven businessmen like Aliko Dangote, Africa’s richest man, are constructing a refinery that could “satisfy Nigeria’s daily requirement of 445,000 to 550,000 barrels of fuel, with spare capacity to export,” according to CNN.

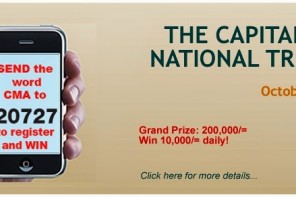

Access to information technology could also be a boon for business. According to techpoint, Data cost has decreased dramatically. Few months ago, 6gig data on the glo network could go for as much as #3000 but now that same amount can get 12Gig data bundle. Also, #3500 that could get about 4gig data bundle on the Artel network can now get as much as 7gig data bundle signifying a huge decrease in data cost. This will suggest that internet penetration is increasing as more people can now get internet access with their smart phones at a reduced data cost.

ALSO READ: NIGERIANS TAKE THE STAGE IN BRITAIN

Also, according to Dailynews.com, the number of smart phone users has remained on the increase with 30% smart phone penetration as against 12% in mid-2015. This signifies great opportunities in no small ways for internet and driven businesses in the country.

Infrastructure investment will also drive growth. Last June, a US fund announced it would raise $2 billion to fund projects in the country. This will help sure up a drop in the country’s $300 billion infrastructure deficit and a positive sign of Nigeria’s potential to attract capital even amid turmoil. This can also be a good time for value investors to go shopping on the equities as most of the quoted companies are cheap and within the value radar. Despite the wobbling, Nigeria remains a hopeful giant. The new hope of the world is the NEKS-Nigeria, Egypt, Kenya and South Africa. With optimism, it is crucial to keep our eyes on the bright spots in Nigeria’s economy.