The world’s economic outlook has been in a sorry state for a while now with many economic indicators pointing downwards. According to theguardian.com, concerns such as slump in energy prices, Hard landing about the Chinese economy, US growth worries and the likes can be held responsible for this. We can authoritatively say that the world economy is experiencing a bear market with Africa being the worst hit due to lack of strategic planning and support from the various protective institutions. A bear market is born when all the major market indices are heading downwards. This market is usually characterized by fear, apprehension, tension and lack of ‘interest to spend’ which further elongates the trend.

There are certain ways to insure yourself and your financial result even in the face of bearish market cycle. Some of these are:

INCREASED FINANCIAL EDUCATION AND INTELLIGENCE

“Financial intelligence is not a way to survive; it is a way of life”. A man who is not financially educated will always lose all his money to the man that is or better still, to the market through unwise and suboptimal business decisions.

You must invest the most in your financial education in times like this. Attend all trainings you can find on money, finance, read all the books and above all, apply all what you read.

STOCKS: You can play different categories of stocks such as:

Value stocks: It was a time like these that men like warren buffet, Benjamin Graham bell and other Value investors gradually “stocked up “their empires. The common thing in bear market is that all stocks head one way: the down way. This makes it a good time to get stocks at a bargain.

DIVIDEND STOCKS: Also considers stocks that have consistent and reasonable dividend growth over the years. Investing in this kind of stocks improves your financial positions through dividend returns and even blesses you the more when the market is finally awake and agile again.

PENNY STOCKS: You can also pick stocks that are priced very low. Because in bear market, such stocks even fall further in value thereby affording you the opportunity to pack a lot of them. Penny stock is such stocks that have very low market price. However, you must know what you are picking. Don’t just pick penny or any other stocks because they are priced low. Do your research to know why such stock is so low. You can also go for

PREFERED STOCKS: These are preferential stocks that afford the holders certain privileges that are not available to the common stock holders. This stock is usually hard to get but is available. If you have some corporate connections that can lead you to these stocks, please use them and hold on to them because they rarely disappoint.

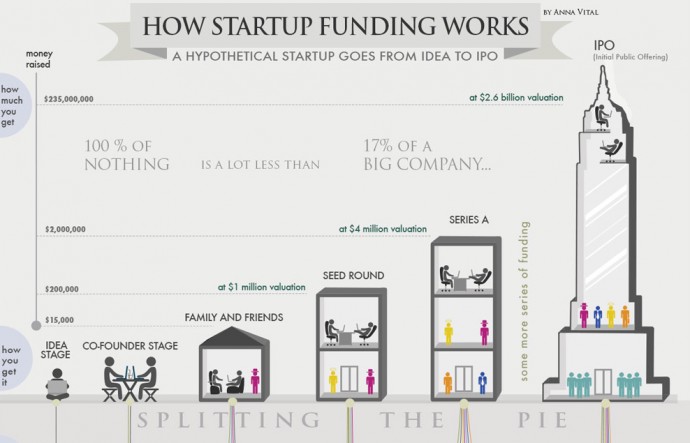

INVEST IN START UPS

Bear market leads to a lot of economic frustrations, layoffs, poverty and the likes. These problems motivate new crop of entrepreneurs who would want to make a difference. Find some of this businesses and key in. Startups struggle for capital during bear market, help them out and smile to the bank later because these crops of investors are the ones that make a tidy profit should their venture survive and succeed. However, the risk associated with startups is quite great and that is why you must have a very strong evaluative technique and strategy. Investment is not a game of luck or charity.

FIXED INCOME INVESTMENTS

Investment in certificate of deposits of commercial banks, corporate or federal bonds are other ways you can secure your wealth in bear markets. Though these securities are deemed safe, the federal government bond is supposed to be the safest as it might not be possible for a country to go bankrupt and fail to honor its debt obligations. You must monitor the debt level and interest consistency of the issuing company or country. But you must know that the idea of investing in bond or similar class of assets is to secure and not expand wealth. The returns on bond are usually very small and some times, doesn’t outperform inflation but at least, your capital is safe and protected from negative economic wind.

SOLID COMMODITIES

Solid commodities such as Gold can also give you good protection and wealth preservation in bear market. You can collect gold Wrist watches, rings and even raw gold if you have the storing g capacity. This remains one of the ways the ultra and sophisticated wealthy men secure their wealth in bear market. You must however be careful and buy wisely.

START A BEAR HAPPY BUSINESS

Certain businesses are insulated to negative economic performances. These include low price businesses, essential commodities, entertainment driven business, education, etc. Starting this kind of business will not only keep you safe in bad times; it will make you rich when the good times finally arrive.

LAST THOUGHTS

Every investment idea in bear market as we have it now is not necessary for wealth expansion but for wealth preservation. You need to have your life and your money intact when the good times come back again and this is the reason why you should consider investment opportunities properly before going in. In making any business move, you must also consider your liquidity, risk tolerance, financial responsibility, long tern goals, emergency possibility, entry and exit strategy and other factors. And above all: Invest with your head and not your heart.