In 2017 the global digital agencies, We Are Social and Hootsuite reported social media users in Africa scaled up 12%, raising the numbers to round about 191 million active users on the continent. Of those, mobile users accounted for 172 million, a majority of whom used only two Facebook-owned platforms: WhatsApp and Messenger. WhatsApp alone reports that users send 65 billion messages per day. It is obvious that mobile phones go beyond mere communication. It is a major channel to get online, as well as a vital tool to access various life-enhancing services such as financial services (mobile money, bank transactions etc). The growing importance of mobile phones and the social media in Africa, did not fail to highlight an urgency that heralded the incorporation of social media networks and mobile phones in the African financial service system, allowing customers to conveniently avoid dreadfully long queues and frustrating complex bank processes. This trending e-banking service is known as chat-banking. Chat-banking integrates artificial intelligence to facilitate a two-way communication system between a financial organization and its customers, to provide quick service and transactional support. Despite its early stages in the service sector, many people especially local business owners, appreciate the reliability and consistency that chat-banking brings to their undertakings.

Find out about Nigerian banks and 2018 strategies

According to Sidharth Garg, founder and CEO of Teller, an automated messaging platform that helps banks and mobile-money companies in developing markets, any organization thinking about launching a chatbot or e-banking must answer the following strategic questions: do we want to treat messaging as another channel or a new experience? What channels do we want to support? How does this change our customer service experience? What kind of budget do we have to support this project? In answering these fundamental questions some financial institutions have been able to distinguish themselves from the others. The United Bank of Africa (UBA), Ecobank and Absa (formerly Barclay’s Africa) have been at the forefront of Fintech in Africa for quite some time. In January 2018, The United Bank Africa introduced an attractive concept known as LEO, an artificial intelligence personality and a 24-hour support service that ushered in a highly interactive side of banking through a simple conversation. “We have been working with technology giants that have the global capacity to ensure not only seamless but also effortless banking for millions of our customers across Africa. We have collaborated with Facebook to come up with this innovation that is capable of revolutionising the way banking is done in Africa,” Mr. Kennedy Uzoka, Group Managing Director, UBA. This service allows its customers to make use of their social media accounts such as Whatsapp and Facebook, to carry out any financial transactions of their choice and at their own convenience. LEO is present in over 14 African countries and available in three languages. In a recent research conducted by Sidharth Garg and his team, LEO has had over 35 million conversations and has processed over 500,000 transactions so far. In 2016 Asba initiated its e-banking service for Twitter and Facebook Messenger. Later this year in July, the company officially launched Whatsapp banking. “As technology advances and more customers become connected, bringing banking to where our customers are important to us, especially as we continue our journey to become a digitally led business driven by innovation,” stated Arrie Rautenbach, Absa’s chief executive of retail and business banking. Aspiring to further boost its position within the African e-financial market Absa has gone into partnership with a mobile messaging firm known as Clickatell, aside from its collaboration with Facebook, as disclosed by Jacques Barkhuizen, Absa retail and banking’s chief information officer for virtual channels.

Discover how entrepreneurs can market at minimum cost

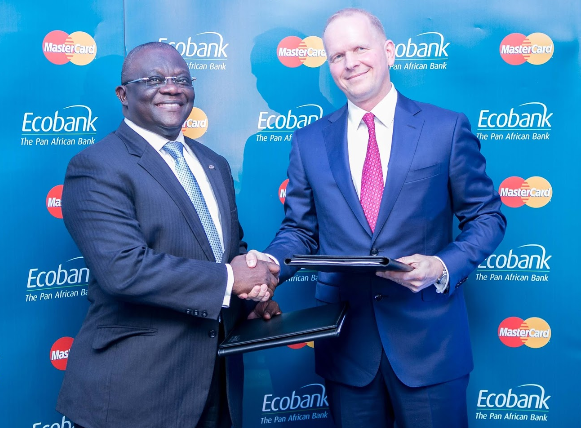

Speaking to Inspire Afrika Magazine Emile Sagna, Head, Transaction Services Group, Ecobank talked about the newly launched Ecobank Mobile App in 33 African countries. The App is expected to assist traders and companies carry out instantaneous financial transactions within the respective countries and beyond borders. “It is not just a product. It is a lifestyle. It is a product that is designed to connect the people of Africa,” reiterates Emile Sagna. Furthermore, Ecobank’s current partnership with the American multinational financial services corporation MasterCard, provides a new Quick Response Service for merchants and businesses across the region. The deal will see Ecobank providing thousands of mobile points of sale devices to retailers in selected African countries, which allow merchants to process MasterCard payment card transactions by connecting their smartphones or tablets to a secure card reader, enabling them to avoid infrastructure and communication challenges that may arise when using traditional POS devices. Consequently, cardholders can access their funds at millions of automated teller machines in Africa and worldwide. Users will also be able to pay for products and services in 210 countries and territories where MasterCard payment cards are accepted. “This actually changes the way we do business. It creates efficiency. It reduces costs. Today we have 11 million customers using the App, but at the end of the day we are planning to get 100 million customers in the next five years,” says Emile Sagna.

Based on the GSMA Intelligence report of 2018, mobile money across the region plays a key role in extending financial services to people with limited access to traditional financial institutions, particularly women and rural populations. There were 135 live mobile money services across the region at the end of 2017, with 122 million active accounts. In 2017, mobile technologies and services generated 7.1% of GDP across Sub-Saharan Africa, a contribution that amounted to $110 billion of economic value added. By 2022, the mobile economy in the region is expected to generate more than $150 billion (or 7.9% of GDP) of economic value added as African countries continue to benefit from improvements in productivity and efficiency brought about by increased take-up of mobile internet in particular. Fintech in not only connecting Africa, but equally building a solid economy on which the continent can take a new and much more secure turn into a brighter future.